Caution: Fraudsters Offering Dispute Resolution Services

Please be aware of organisations or individuals using the TransUnion Africa web address to advertise services for clearing credit disputes. This is a scam. TransUnion does not handle disputes over social platforms or online classifieds, nor do we charge a fee for investigating disputes.

The only way to dispute information on your TransUnion credit report is by emailing keninfo@transunion.com/info@transunion.com or contacting Tel: +254 768262495, +254 768617074, +254 768253748, +254 706565285

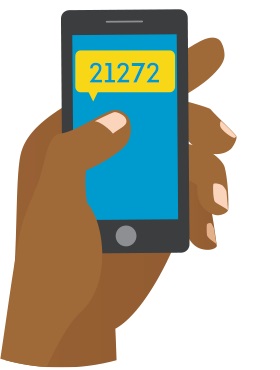

Text your name to 21272 to check your credit status.

How does TransUnion Nipashe work?

TransUnion Nipashe gives you accurate, up-to-date information about your credit status in real-time; it’s quick and easy-to-use.

Be Credit Confident — Watch These Short Videos

When you apply for credit, lenders check your credit report and credit score before approving a loan. The better you understand what these are and how they work, the better you can manage your finances and transact with confidence.

What is a credit report?

Find out where the information comes from, how it’s used and how to access your credit status.

What is a credit history?

Learn the difference between a good and bad credit history — and how to improve yours.

How can I get my credit status?

Use your mobile to access your credit status or request a clearance certificate.

Myth or fact?

Can you fix a bad credit score? Is a credit report expensive? We get straight to the facts.

For more information download our frequently asked questions

Why do I need to check my credit status?

In order to increase the chances of being approved for a loan it is recommended that you check your credit status before and get your financial affairs in order.

How does credit work?

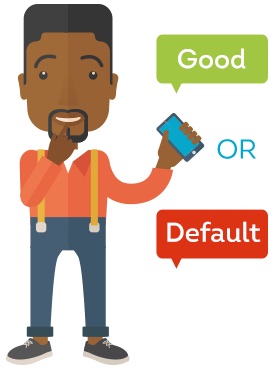

Every time you apply for a loan, lenders check your credit profile

to see if you have a good credit history.

If you pay your loans back on time it affects your credit profile positively.

If you pay late or miss payments it affects your credit profile negatively.

How can TransUnion Nipashe help you?

TransUnion Nipashe also offers the following to help you get your finances in order:

Additional Consumer Resources

Contact Us

We're sorry, your request failed. Please try again in a little while.