Q2 2020 Market Analytics Report

Kenya’s Market Analytics Report provides a comprehensive view of the credit market

Q2 2020 Highlights

Impact of COVID-19 Pandemic Reflected in Industry Credit Data

- Non-performing loan rates have been affected by Central Bank of Kenya directives — no new non-performing accounts were listed in Q2 2020.

- The number of active credit card clients declined by 15.0% from Q1 2020.

- A significant uptake of the new overdraft product, Fuliza, accounts for the rise in credit disbursements in overdraft loans over the last quarter.

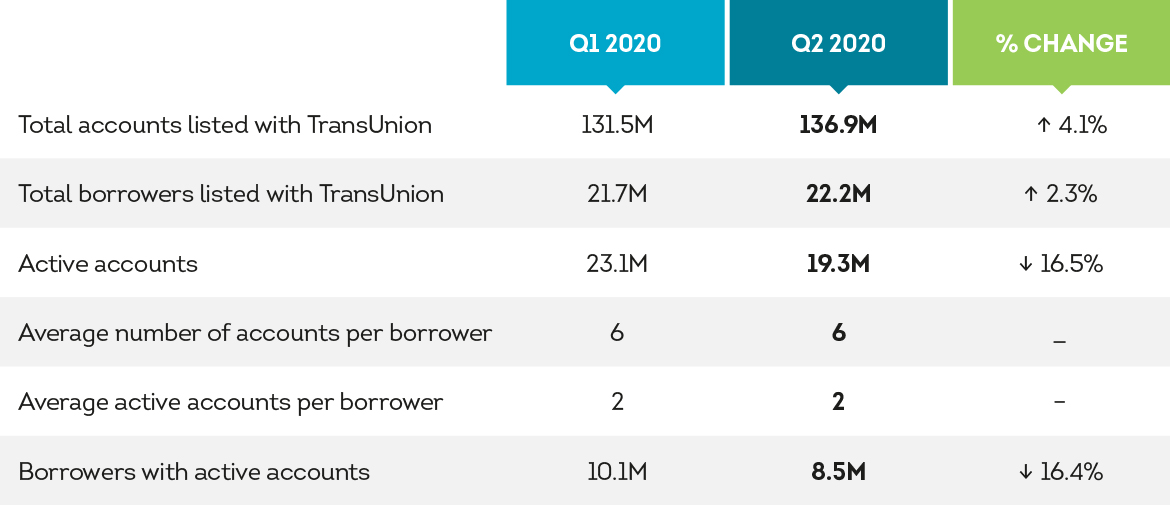

The newly released TransUnion Q2 2020 Kenya Market Analytics Report reflects the impact of the COVID-19 crisis on the credit market, with the number of active accounts down 16.5% from the previous quarter. Non-performing loans declined due to the restructuring of loans by banks, along with Central Bank of Kenya directives which affected data submitted to the bureau. The regulations led to 6.7 million accounts being deleted from the bureau.

“Many businesses have made a fast transition to new technologies and new ways of working which has accelerated the adoption of digital financial services — something consumers will expect more and more. Lenders need deep insight into the market to develop innovative products that will reach new customer segments and contribute to their long-term success. This is what the Q2 2020 report provides.”

- Samuel Tayengwa, Product Director TransUnion Rest of Africa.

Overview of the formal lending market in Kenya, Q2 2020

(1)Formal lending is a measure of financial inclusion. Formal financial products and services are defined as those offered by financial service providers that are regulated and supervised by an independent statutory government agency (including the Central Bank of Kenya, Capital Markets Authority of Kenya, Insurance Regulatory Authority, Retirement Benefits Authority and the Sacco Societies Regulatory Authority).

About the TransUnion Kenya Market Analytics Report

TransUnion’s Kenya Market Analytics Report provides a comprehensive view of the credit landscape and detailed analyses of market trends, opportunities and risks.

Based on bureau data, the report looks at major lending categories: mobile loans, personal loans, asset finance, overdraft, credit cards, mortgages and trade finance. The report provides data and commentary on each category, including: market overview (lending limits, number of active and performing accounts, number of lenders), originations (new accounts opened), account performance (defaults) and account risk.

Lenders can use the report to analyse market dynamics over an entire business cycle and understand changes in consumer behaviour.

INFOGRAPHIC

Get an overview of the important facts, findings and insights from this quarter’s report

TransUnion Africa, 2nd Floor Delta Annex, Ring road, Westlands, Nairobi, Kenya

Copyright © TransUnion LLC. All rights reserved.

Read our privacy policy